Introduction

For many businesses, a reliable van isn’t just a convenience—it’s a necessity. It serves as a mobile office, a warehouse on wheels, and the primary way you connect with customers. However, the price tag on a new or quality used commercial vehicle can be a significant hurdle. Dropping a large lump sum of cash upfront isn’t always feasible, or smart, for maintaining healthy business cash flow.

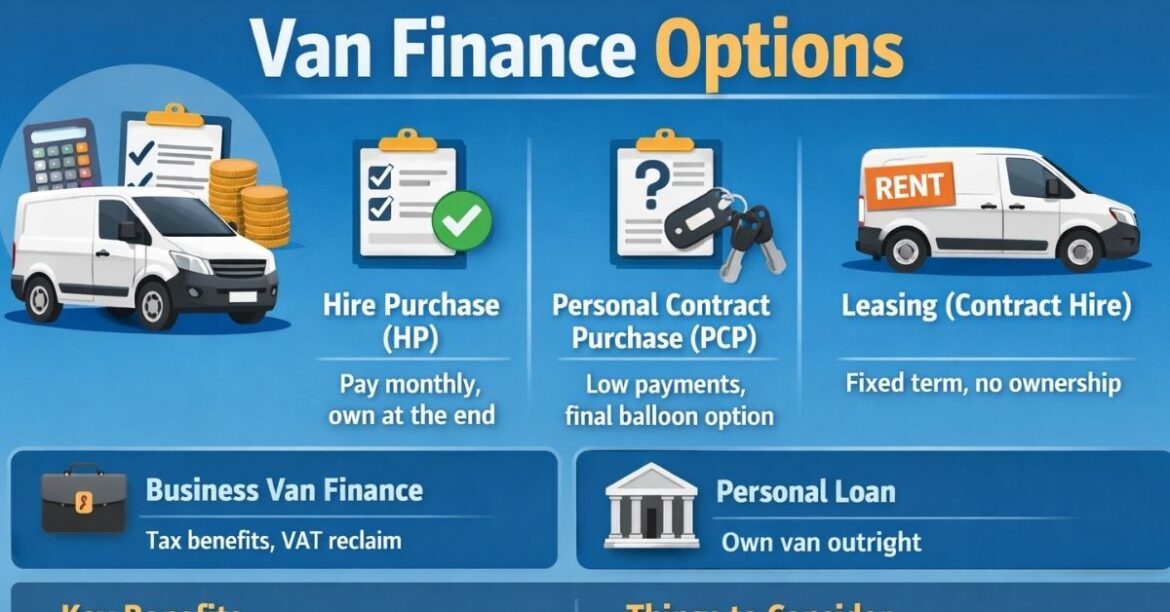

This is where van finance comes into play. It offers a pathway to get the keys to the vehicle you need right now, while spreading the cost over a manageable period. But the world of vehicle financing can be dense with jargon. From leases to loans and balloon payments, understanding which option aligns with your business goals is critical.

This guide breaks down the different types of van finance available, helping you make an informed decision that keeps your business moving without stalling your bank account.

Understanding Van Finance Basics

At its core, van finance is a borrowing agreement that allows you to pay for a vehicle over time. Instead of paying the full purchase price in one go, you pay a deposit (usually) followed by monthly installments.

Depending on the specific type of agreement you choose, you might own the van at the end of the term, return it, or have the option to buy it for a lump sum. The right choice depends on your budget, how you use the vehicle, and your long-term business plans.

The Main Types of Van Finance

There is no “one size fits all” solution. Lenders offer various structures to suit different needs. Here are the most common methods.

1. Auto Loan (Hire Purchase)

This is the most straightforward route to ownership. You pay a deposit upfront and then pay off the balance of the van’s value, plus interest, over a set period (typically 12 to 60 months).

Once you have made the final payment, you own the vehicle outright. This is an excellent option if you plan to keep the van for a long time and want an asset on your balance sheet.

Pros:

- You own the vehicle at the end.

- No mileage restrictions (since you are buying it).

- You can modify the van (racking, signage) as you see fit.

Cons:

- Monthly payments can be higher compared to leasing.

- You are responsible for maintenance and repairs once the warranty expires.

- You bear the risk of depreciation.

2. Commercial Lease (Contract Hire)

Think of this as a long-term rental. You pay a monthly fee to use the van for a set period (usually 2 to 4 years). At the end of the contract, you simply hand the keys back to the finance company.

This is popular for businesses that want to upgrade their fleet regularly to have the latest models and technology without the hassle of selling the old vehicles.

Pros:

- Lower monthly payments compared to loans.

- Maintenance packages can often be included in the monthly cost.

- You avoid the hassle of reselling the vehicle or dealing with depreciation.

Cons:

- You never own the vehicle.

- Strict mileage limits apply; exceeding them results in penalties.

- The van must be returned in good condition (wear and tear guidelines apply).

3. Finance Lease

This is a hybrid option often used by businesses that need the tax advantages of leasing but want some equity in the vehicle. You pay monthly rentals, but at the end of the term, you don’t own the van. Instead, the van is sold to a third party.

Here is the twist: You usually receive a large portion of the proceeds from that sale (often around 95-99%). It acts as a way to benefit from the vehicle’s residual value without technically taking ownership.

Pros:

- Tax efficient for many businesses.

- Flexible payment structures (e.g., lower monthly costs with a final “balloon” payment).

- You benefit if the van holds its value well.

Cons:

- You take on the risk; if the van sells for less than the estimated residual value, you might owe money.

- You don’t automatically own the vehicle at the end.

Key Factors to Consider Before Signing

Before committing to a contract, you must evaluate your specific business situation.

Your Credit Score

Just like a personal loan, your business or personal credit history dictates your eligibility and the interest rate you will be offered. A strong credit score unlocks lower interest rates (APR), making the van cheaper overall. If your credit is poor, finance is still possible, but it may require a larger deposit or come with higher monthly payments.

Mileage Requirements

If you choose a leasing option, be realistic about your mileage. Underestimating your annual mileage to get a cheaper monthly rate can backfire with expensive excess mileage charges at the end of the contract. If you are buying via an auto loan, mileage impacts the resale value, but you won’t be fined for driving too much.

The Total Cost of Ownership

Don’t just look at the monthly payment. Calculate the total amount repayable, including the deposit, all monthly payments, interest, and any final balloon payments. Sometimes a deal with low monthly payments ends up costing thousands more in the long run due to high interest or a massive final lump sum.

Driving Your Business Forward

Selecting the right van finance option is about balancing your current cash flow needs with your long-term asset goals. If you want to own the van eventually, a loan or hire purchase is likely your best bet. If you prefer lower monthly costs and a new van every few years, leasing is the superior choice.

Take the time to compare quotes from different lenders and read the fine print regarding mileage and wear and tear. The right financial foundation will ensure your new vehicle becomes a profitable tool for your business, rather than a financial burden.

Frequently Asked Questions

Can I get van finance with bad credit?

Yes, it is possible. There are specialist lenders who focus on subprime finance. However, be prepared to pay higher interest rates or put down a larger initial deposit to secure the loan. Lenders need reassurance that you can meet the monthly repayments.

Is maintenance included in van finance?

It depends on the agreement. With a standard Auto Loan (Hire Purchase), maintenance is your responsibility. With Commercial Leases (Contract Hire), you can often add a maintenance package for an extra monthly fee, which covers servicing, tires, and sometimes repairs.

What is a “Balloon Payment”?

A balloon payment is a lump sum paid at the end of a finance agreement. By deferring a chunk of the cost to the end, your monthly payments are significantly lower during the term. However, you must have the cash ready to pay this final amount if you want to keep the vehicle.

Can I wrap or sign-write a financed van?

If you are buying the van (Auto Loan), yes. If you are leasing, you can usually apply decals or wraps, but you must remove them and restore the paintwork to its original condition before returning the vehicle. Always check the specific terms of your contract first.

How much deposit do I need?

Typically, lenders ask for a deposit equivalent to 3 to 9 months of payments, or a specific percentage of the vehicle’s value (e.g., 10% or 20%). Some “no deposit” deals exist, but they usually require excellent credit scores.